How does Fire Equipment affect my Insurance?

The nature of the industry in which you operate will no doubt have dictated the nature of the insurance that your business holds.

While only employers’ liability insurance and commercial motor insurance (if vehicles are in use at your business) are the only legally compulsory policies for companies, there are a number of other coverage options to protect your premises, your employees and your equipment/products against the threat of fire.

One of the most common of these is commercial property insurance, which is sub-divided into buildings insurance and contents insurance, covering your business against the risk of flooding, riots, storm damage and, of course, fire.

Defaulting on Insurance

Commercial property insurance will cover your business and its contents up to the amount specified in the policy, but if you violate the terms you could find that your provider will not pay out in the event of an incident.

There are a whole range of fire safety factors that could affect or even invalidate your insurance if they’re overlooked or ignored, including:

- Lack of up-to-date fire risk assessment.

If your fire risk assessment, required under the Regulatory Reform (Fire Safety) Order 2005, has not been carried out then this could violate some commercial property insurance policies. Similarly, changes to your business (including building alterations, significant increase in staff numbers, the employment of vulnerable persons and changes to practices/equipment) should prompt a revision of the assessment.

- Serviced and certificated extinguishers.

If a fire occurs and your on-site fire extinguishers are found to be outdated in their certification, then this could invalidate your insurance. To ensure that your units stay updated, have them serviced regularly, as well as replaced and discharged at the following intervals:

Discharged and refilled every 5 years and replaced every 20 years: Water, dry powder, foam.

Replaced every 10 years: CO2.

- Sprinklers.

Although not an explicit requirement of many policies, having a sprinkler system fitted as part of your business’s fire safety setup can often help to reduce the cost of commercial property insurance – usually between 5-15%.

Changes to BS 5306-8

The end of 2013 saw a few alterations to the British Standard BS 5306-8, the legislation that covers fire extinguishing equipment and installations. Some of these may affect your commercial property insurance policy, so check with your provider.

- Dry powder extinguishers.

New regulations state that dry powder extinguishers can no longer be kept indoors unless special dispensation is awarded. Non-compliance with this violates British Standards and can affect your insurance.

- Extinguisher numbers.

Where once a small office only required one extinguisher, two is now the minimum for single storey properties in order to comply with regulations.

- External extinguishers.

Those units kept outside of buildings that contain antifreeze must now have their contents replaced every year, as well as being inspected for corrosion.

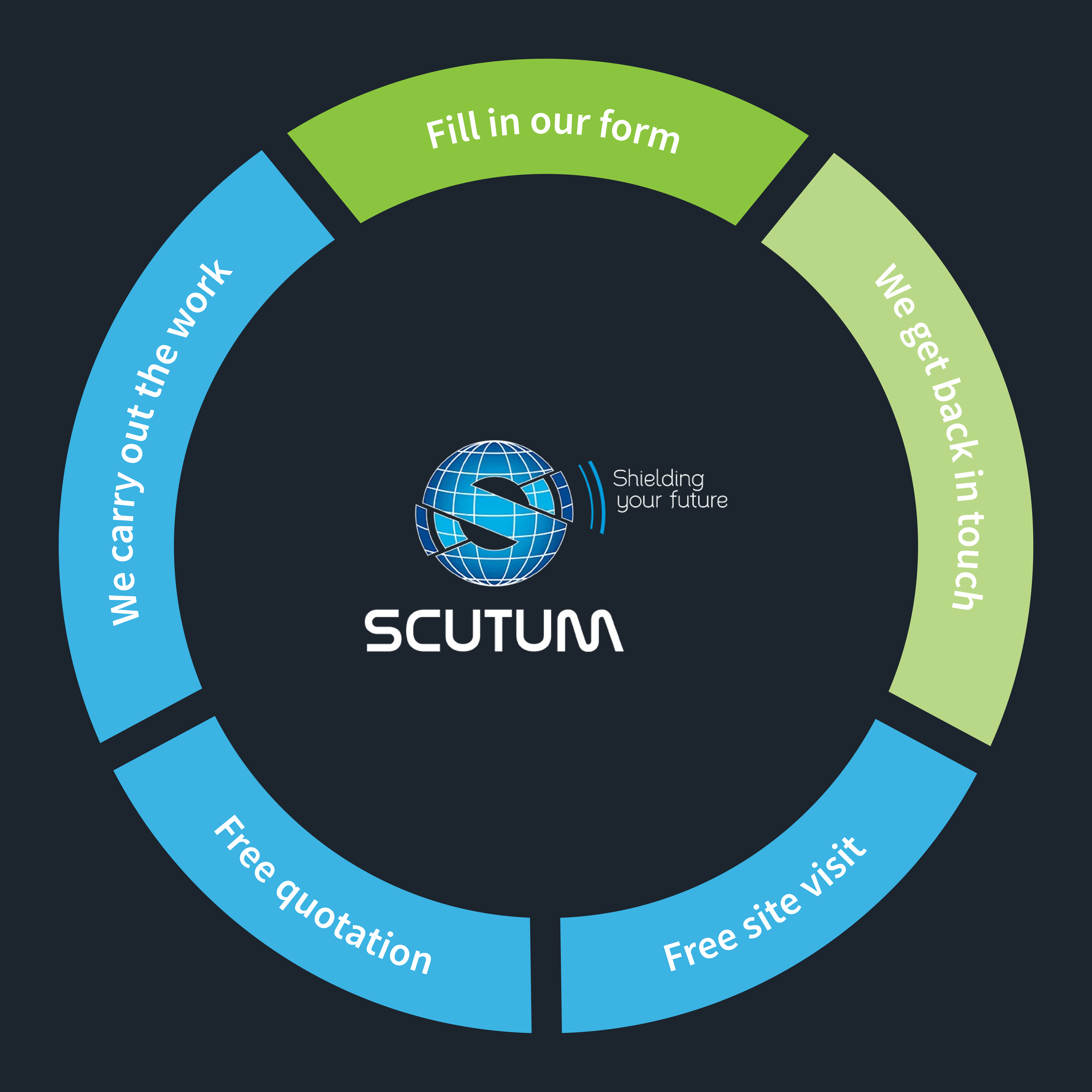

Request a Callback

Just fill in your details below and we'll get back to you as soon as we can!

About Scutum London

Scutum London is a leading expert in fire safety and security solutions for businesses and organisations located across South East England, including London and Surrey.

From fire alarms, fire extinguishers and fire risk assessments to access control, CCTV and intruder alarm systems – and a lot more besides – we offer a comprehensive range of products and services designed to keep you, your business and your staff and visitors safe.

With decades of industry experience to call on, we’re proud to hold accreditations from leading trade associations and bodies such as British Approvals for Fire Equipment (BAFE), the British Fire Consortium, the Fire Industry Association (FIA) and Security Systems and Alarms Inspection Board (SSAIB).

If you’d like to find out more about Scutum London, get in touch with our friendly team or explore our products and services on our site.